Gambling is extremely popular among Canadians and contributes to the budget by providing a significant income. In 2024, it amounted to $4.19 billion. However, gambling has not always been legal in Canada. The FortRoddHill experts conducted in-depth research and analyzed all historical milestones, legislative acts, and cultural shifts that led to the legalization of gambling in the country. We will also tell you what system is used to tax the winnings the lucky winners managed to get. Would you like to learn more? Read our article!

When Did Casinos First Become Legal in Canada?

1970 is considered the year gambling became legal in Canada. Quite a long history preceded its legalization.

Gambling has been illegal in Canada since 1892, when this point was added to the Criminal Code. However, in 1910, the government revised its opinion and allowed betting on the totalizator. In 1925, the restrictions were further softened, and gambling events were allowed at fairs. In 1969, lotteries were legalized, and the following year, the government allowed 10 provinces to permit and conduct gambling on their territory.

When Did Gambling Become Legal in Ontario?

Like in other Canadian provinces, gambling became legal in Ontario in 1969. Online gambling was legalized on April 4, 2022.

The landmark years were 1969 (amendments to the Criminal Code) and 1975 (creation of OLG — Ontario Lotteries and Gaming Corporation). In 1994, the first land-based casino, Niagara, appeared, and the gambling industry in the province began to grow rapidly.

When Did Gambling Become Legal in Quebec?

In Quebec, gambling became legal with the creation of Loto-Québec in 1969. Initially, this organization issued permits for lotteries, but after a while, it also started to create video games. You can still play one of them, 6 /36 Lotto. The first land-based casino in the province (Casino de Montréal) opened in 1993, and this marked the beginning of land-based gambling in Quebec.

History of Regulation

The FortRoddHill team discovered that gambling in Canada dates back to the 14th century. Even before the arrival of European settlers, Indigenous peoples played games, which were not just a way to entertain but also a means of teaching life skills and passing on traditions. The games expanded when settlers arrived in Canada in the 15th century. However, Europe influenced the natives’ moral and legal views, so gambling was not legalized in Canada until the early 20th century. The exception was betting on horse races. Horse racing was always considered a gentleman’s sport, so it was not prohibited.

Realizing the country could benefit economically from gambling, the government took the first steps toward legalizing it in 1910. Since then, it has gradually allowed more forms of gambling. The breakthrough came in 1969, when amendments to the Criminal Code were passed, and lotteries were allowed.

In the 1970s, the government began issuing gambling licences in Canada. They were pretty expensive to obtain, so even though gambling became legal, only rich people could afford to gamble in licensed establishments. The poor ones had to visit illegal places if they wanted to have some fun.

In 1985, the Criminal Code was amended to allow provinces to supervise and regulate video lottery terminals (VLTs) and electronic gaming devices. The first legally authorized Canadian casino opened in Winnipeg in 1989 (Crystal Casino), followed by Montreal in 1993 (Casino de Montréal), and the next was Niagara in Ontario in 1994.

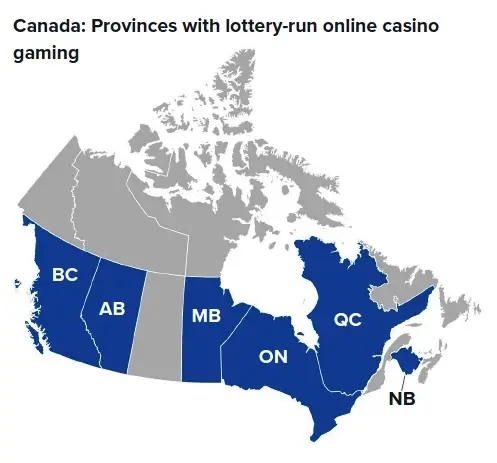

Online casinos are also regulated in Canada. Quebec was the first province to introduce state-regulated online gambling. The games were controlled by Espacejeux, a company operated by Loto-Québec. In 2022, Ontario became the first province to launch a fully open and regulated iGaming marketplace, allowing private operators to offer online casino and sports betting services.

The Gambling Regulators That Operate in Canada

In Canada, gambling is regulated by the following organizations:

- Ontario: The Ontario Lottery and Gaming Corporation (OLG) and the Alcohol and Gaming Commission of Ontario (AGCO) have full regulatory control over land-based and online casinos.

- Quebec: Loto-Québec is the regulatory body overseeing land-based and online gambling.

- British Columbia: British Columbia Lottery Corporation (BCLC) is responsible for overseeing lotteries and casinos.

- Alberta: Alberta Gaming, Liquor and Cannabis (AGLC) monitors all provincial gambling activity.

- Manitoba: Manitoba Liquor and Lotteries Corporation (MBLL) regulates VLTs, lotteries and casinos.

- Saskatchewan: The province’s gambling industry is overseen by three regulatory bodies: the Saskatchewan Indian Gaming Authority (SIGA), the Saskatchewan Liquor and Gaming Authority (SLGA) and SaskGaming.

- Nova Scotia: Lotteries and land-based and online casinos are controlled by Nova Scotia Gaming Corporation (NSGC).

- New Brunswick: The New Brunswick Lotteries and Gaming Corporation (NBLGC) is this province’s main regulatory body overseeing gambling activities.

- Newfoundland and Labrador: Gambling activities are managed by the Atlantic Lottery Corporation (ALC).

- Prince Edward Island: The Prince Edward Island Lotteries Commission is the only regulatory body controlling lotteries and gambling operators.

- Yukon, Northwest Territories, and Nunavut: Local or municipal governments regulate gambling activities. The Western Canada Lotteries Corporation (WCLC) administers the lotteries.

Which Taxes on Gambling Winnings Exist in Canada?

The FortRoddHill‘s review team analyzed Canadian legislation and learned that the winnings are tax-free if you play at land-based or online casinos. The same applies to money from lotteries, poker and sports horse racing. It is worth considering that although the winnings themselves are not taxable, any income from their investment (e.g. interest, dividends) is taxable under Canadian tax law.

Only money received as a result of professional activities is taxable. The Canada Revenue Agency determines this case, for example, if a person demonstrates skill or experience in gambling, such as being a professional poker player or sports bettor, or if the winnings are their primary income.

Summary

The FortRoddHill experts analyzed the Canadian legislation and found that gambling is legalized in Canada. You can play at land-based and online establishments controlled by local supervisory authorities (different in each province). Winnings received are usually not taxable in Canada as long as it is not a professional activity. All domestic and foreign casinos must adhere to Canadian law, including the Criminal Code, and be licensed.

Gambling not only brings players entertainment but also good income to the budget. Based on this, we assume that the Canadian casino industry will continue to grow, which means you will have access to more games and winnings.