Many dream about a utopia where everyone is equal, and the Canadian government was probably inspired by that when the equalization payments were introduced in 1957. It is a fair system that ensures every Canadian has access to the same quality of public services regardless of where they live. Let’s take a closer look at the history of equalization payments by province in this article to see how it has all started and works nowadays. The FortRoddHill experts have also prepared a table with payments received by each province and have had a deep dive to see if every province is satisfied with such a system.

What Are Equalization Payments?

In simple words, this is the governmental program introduced in 1957 in Canada that divided all the collected taxes fairly among provinces. Its goal was to make sure areas with poorer economies were funded more and had enough money to provide decent public services to citizens. This way, Canadians in all the provinces receive equally good services regardless of the economic situation in the area. The principle of equality in the program’s core gives the name to the Equalization Payments initiative. The way it works in Canada is considered one of the fairest in the world.

How It Works

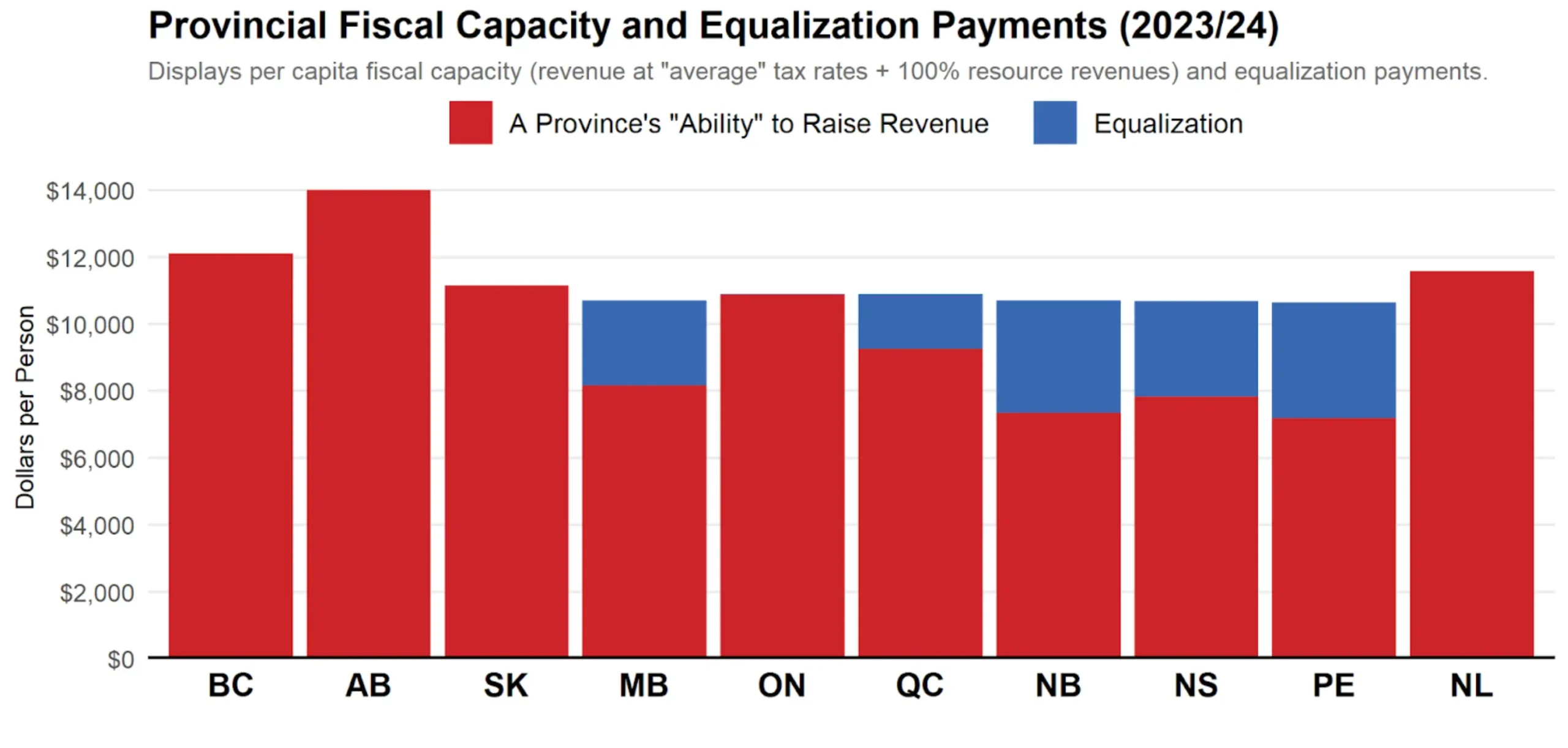

Provincial equalization payments are paid from the government’s general revenue, which is composed of federal taxes. Yes, each province contributes to the federal taxes, but provincial governments do not contribute to it in any way.

Based on the sum of the general revenue that is planned to be used for this program, the calculations are made to determine the size of the financial aid each struggling province should receive. Practically all the sources of revenue are taken into consideration in those calculations. What is especially interesting is that every province in Canada receives an equalization payment, but not every year. For example, Alberta received such a payment last time in 1964, while Ontario did not need it until 2009, when the financial crisis began.

When Did Equalization Payments Start in Canada?

In Canada, equalization payments have existed for almost 70 years already, and they have already proved their effectiveness. Each province has faced a financial crisis or problems at some point, and this governmental aid improved the situation significantly. Therefore, a continuity of high-quality public services for each Canadian was preserved. Let’s look at the history of equalization payments from their establishment until now.

Predecessors

A mechanism for providing financial aid to certain provinces has existed since the Canadian Confederation, and it was even enshrined in the Constitution Act in 1857. At that time, the only province that could have taken advantage of it was New Brunswick. At the same time, the Constitution included a significantly greater taxation possibility for the general government than it was for the provincial government.

The Original System (1957)

The first Canadian equalization payments were introduced in 1957. At that time, the purpose of the program was to ensure that all provinces had the same per-capita revenue. It was achieved through shared taxes. Those included personal income taxes and corporate income taxes, as well as succession duties. The size of the financial transfer from the governance was calculated to meet the revenue of the two wealthiest provinces in Canada. At that time, those were Ontario and British Columbia.

Tax Base Expansion (1962-1967)

The abovementioned system worked without changes until 1962, when matching the revenue of the two richest provinces was no longer considered a good idea. Instead, the payments were calculated based on the all-province average. Moreover, the recipients were given compensation that allowed them to have 50% revenue of the per-capita average. In 1967, the proportion of the personal income tax was increased to 24% (from the initial 10% set in 1957). The modern provincial equalization payments still follow the format of 1967.

Energy Crisis and Economic Turbulence (1970s)

For most of the categories or revenue, taxation was set at the national average level. The only exception was energy. Thus, the equalization payments in Canada were the most comprehensive among those existing in the world. It was so until the energy crisis happened, and prices soared in 1973. Given the domestic prices, the transfers would have tripled. Moreover, equalization of energy revenues would also increase the payments. Furthermore, Ontario should have been included in the list of recipients. To avoid this, only 50% of resource revenue was to be equalized. Nonetheless, this measure did not prevent Ontario from receiving financial aid through 1977-1982.

To balance the system and ensure that the payments are not extremely high, the concept of the nationwide average level was declined. Instead, the average of five provinces, namely Columbia, Saskatchewan, Manitoba, Ontario, and Quebec, were taken into consideration. As a result, Ontario was no longer able to qualify for aid, and the energy prices influenced the equalization payments sum less because Alberta’s revenue was not used in the calculations.

Constitutional Recognition and Formalization (1982)

In 1982, the Canada Act that amended the Constitution was accepted. It included the right of the poorer provinces to receive equalization payments. After this measure, a sudden cancellation of the program was not possible. Starting in 1984 and until the 2000s, around 22% of the federal government’s revenue was spent on such payments.

The revision of the former was to happen in 1987, but it was postponed for several years because of the changes in taxation and the special status of Newfoundland and New Scotia. However, through the years, it has become clear that the reform was not something extremely necessary, and the system as it was in 1982 existed successfully for the next 20 years.

Reform Proposals (2000s)

During those 20 years, no changes were made, but the system needed some alterations. Thus, a reform of the equalization payments in Canada was inevitable. The discussions began in 2004, and the government and provinces agreed to change the existing formula and move from the calculations based on the revenue of provinces. Instead, fixed funding levels should be implemented, and they would grow at fixed rates. Therefore, the economic performance of the provinces would not influence the payments.

In 2005, an expert panel was established, and it should have created a roadmap for future changes. The panel released a report in 2006. The same year, the conservative party won the elections, and Stephen Harper committed to bringing the changes to life. Based on the report, Minister of Finance Jim Flaherty reinstated the formula-driven calculations in the equalization program. The formula was enhanced with the transition to a standard based on the national level. Moreover, a fiscal capacity cap was added in order to make sure that the fiscal capacity of a recipient province would not be higher than that of a province that did not receive a payment.

The opposition criticized the Conservative Party for not changing the formula. It eventually led to the “Anything But Conservative” movement. However, it was not until 2009 that the new changes to the equalization payments were made. The fiscal capacity cap was modified, and a ceiling and floor on aggregate payments were added.

Implementation and Withdrawal (2009-2014)

Aside from the equalization payments, the Total Transfer Protection (TTP) was introduced. It was done to ensure that a province would have financial support to face the economic challenges if the government reduced payments, as well as Canada Health Transfer (CHT) and Canada Social Transfer (CST). The transfer could not be less than the sum for the previous fiscal year (including CHT, CST, equalization and Territorial Formula Financing (TFF)).

Until its cancellation, the program provided payments to 7 provinces, including the four Atlantic provinces, Manitoba, Saskatchewan, and Quebec. They received payments for a total of $2.2 billion. TTP was cancelled in 2014. It was a political decision because of the pressure from Ontario’s Liberals, who claimed that they were deprived of $640 million.

Recent Developments and Current Structure (2019-2024)

The equalization payments and TTP were renewed for five years starting in 2019. Under this new plan, the government has increased payments to provinces from $18.3 billion in 2017–2018 to $22.1 billion by 2022–2023. Not all the provinces were satisfied with the renewal. Thus, the governments of Alberta and Saskatchewan criticized it because there had been no proper consultations and discussions of the formula.

Historical Equalization Payments by Province

| Province | 2014-2015$M | 2015-2016$M | 2016-2017$M | 2017-2018$M | 2018-2019$M | 2019-2020$M | 2020-2021$M | 2021-2022$M | 2022-2023$M | 2023-2024$M |

| Alberta | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| British Columbia | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Manitoba | 1,750 | 1,738 | 1,736 | 1,820 | 2,037 | 2,255 | 2,510 | 2,719 | 2,933 | 3,510 |

| New Brunswick | 1,666 | 1,669 | 1,708 | 1,760 | 1,874 | 2,023 | 2,210 | 2,274 | 2,360 | 2,631 |

| Nova Scotia | 1,619 | 1,690 | 1,722 | 1,779 | 1,933 | 2,015 | 2,146 | 2,315 | 2,458 | 2,803 |

| Newfoundland and Labrador | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Ontario | 1,988 | 2,363 | 2,304 | 1,424 | 963 | 0 | 0 | 0 | 0 | 421 |

| Prince Edward Island | 360 | 361 | 380 | 390 | 419 | 419 | 454 | 484 | 503 | 561 |

| Quebec | 9,286 | 9,521 | 10,030 | 11,081 | 11,732 | 13,124 | 13,253 | 13,119 | 13,666 | 14,037 |

| Saskatchewan | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | 16,669 | 17,341 | 17,880 | 18,254 | 18,958 | 19,619 | 20,573 | 20,911 | 21,920 | 23,963 |

Equalization Debate by Province

Even though the system of equalization payments looks fair, it has been constantly criticized by the governments of the wealthy provinces that rarely receive such payments. They consider it unfair since even though a province does not pay money to other provinces, a government does. This program creates dependency of provinces on the government and makes them reluctant to raise taxes.

Alberta

Alberta Finance Minister Joe Ceci said that Alberta did not receive payments even during the years of recession, as its economy is mostly resources-based, and they are not included in the formula. Thus, he would like to see a change in the system. Moreover, an Edmonton Journal article from December 2018 claimed that Alberta received 0.02% of all payments, the last of which was in 1964–1965. Another argument for the unfair nature of equalization payments in Canada was expressed in an opinion column article by economist Trevor Tombe. He said that Alberta has the lowest percentage of the population aged 65 and above. As a result, there are fewer CPP and OAS recipients. Finally, in a referendum on equalization, 61.7% of Alberta voters agreed that equalization payments should be removed from the Constitution.

Quebec

The biggest criticism of the equalization payments for Quebec is related to the fact that this province receives transfers each year, even though its citizens pay the lowest federal tax in the country. Furthermore, domestic users received hydropower below market sales, and it was not taken into consideration for payment calculation. That fact was another reason for criticism. Also, Quebec shows the slowest economic growth out of those provinces that receive transfers regularly, even though it gets the lion’s share of the payments.

Ontario

Ontario is one of those provinces that benefit the least from the program. Until the economic recession in 2008, it had never received payments. A censored federal report in 2006 stated that this province did not qualify for financial aid because wages and cost-of-living expenses were never taken into account. In 2014, Ontario would have received payment due to the TTP program, as Ontario’s per capita payments were the lowest, but it was cancelled in 2013.

Summary

We have explored Canadian equalization payments in more detail and analyzed their benefits and drawbacks. Moreover, we have discovered the evolution of the system since its launch in 1957. Based on the findings, the FortRoddHill analysts can state that this initiative was absolutely necessary for certain provinces and was a fair way to provide decent public services to the citizens of territories with poor economies. Despite that, some provinces that have rarely received such money transfers from the government consistently criticize the program.

FAQ

When Were Equalization Payments Implemented?

Equalization payments were implemented in 1957.

Why Does Quebec Get So Much Equalization Payments?

This is mainly because of the large population of the province, which comprises 51% of the population in Canada.

Why Were Equalization Payments Established in 1957?

Equalization payments were established to support provinces with low-performing economies and to ensure that all Canadians have equal access to high-quality services.